Stress-Testing Your Asset and Corporate Structure

August 2020 - 3 min read

A tumultuous new reality has spread across the international economy. While some will weather troubled times well, or even profit from them, others will experience a more negative impact. Competent financial planners will consider different scenarios that could leave you and your family vulnerable and affect your financial well-being. These scenarios include contracting a critical illness, market downturns, or a premature death. This type of “stress testing” is prudent.

To use a medical analogy, it is not unheard of for a man in his late 40s to develop prostate cancer, despite the relatively young age. However, by attending periodic medical check-ups, it is quite possible to have an early diagnosis, immediate treatment, and recover from the cancer well. Why would a person not get regular medical check-ups, especially after a certain age, to avoid the grim alternative? Attending a routine check-up for your wealth plan is equally prudent to care for your financial health.

Although prudent financial planners will stress-test a portfolio, it is much less common to stress-test a corporate and legal structure. There are many circumstances beyond the risks of financial markets that can destroy wealth. To name a few:

- Legal uncertainties - laws are enacted and repealed; courts interpret laws over time in unexpected ways

- Limits of insurance - escalation of premiums for certain types of risks; broad exclusory clauses; increasing categories of uninsurable risks (e.g. overland floods)

- Professional liability risks (who is your partner?)

- Directors’ and officers’ liability

- Real estate owners’ risks (strict and vicarious liability)

- Family risks (marital breakdown; estate disputes), and

- Other economic risks.

What impact would negative events in these areas have on your personal and business assets? Unfortunately, those with deep pockets are potential targets for those with grievances. This can lead to lawsuits and, in a worse case, a judgment. A non-consensual creditor who receives a judgement against you or a corporate entity may then enforce against the assets. However, by being proactive and planning in advance of any potential liability, many valuable assets may be kept out of harm’s way. This planning can also prevent personal or family problems from developing into financial problems.

Some corporate structures for owners of private companies may be simple, such as an operating company owned by one shareholder, or a professional corporation. Other structures may be very complex, including various holding companies, trusts, and assets in multiple jurisdictions. To assess whether a stress test is worthwhile, ask yourself the following questions:

- Are there adult children who are shareholders of your corporation?

- Do you own rental property?

- Do you have a significant non-registered portfolio (e.g., held outside an RRSP or other pension product)?

- Do you have corporate-owned life insurance?

- Do you own the building in which your business operates?

- Do you have more than one corporation, with payments such as management fees or rents flowing between them, or loans owed from one to another?

- Are there any inter-corporate loans between your operating company and one or more holding companies?

- Are there any investments or significant amounts of cash held inside a corporation?

- Do you have any assets outside Canada?

- Are you a director or officer of a corporation – aside from your own business?

- Do you have any business partners?

- Is your current business structure subject to unnecessary tax or other costs?

If you answered yes to any of the above questions, it is a worthwhile exercise to stress-test your legal structure.

Like a medical check-up, a stress test of your legal or asset structure is far more effective if it is done regularly and well in advance of a problem arising. Once a liability arises, various fraudulent conveyance and fraudulent preference laws can preclude the opportunity to do effective asset protection planning. Asset protection may be thought of as pre-litigation planning. Even if a legal structure is “healthy” from an asset protection standpoint, a review of the structure may reveal opportunities for increased tax efficiencies in your business, better succession planning, or a safer estate plan to preserve your legacy.

Value of Asset Protection Structuring

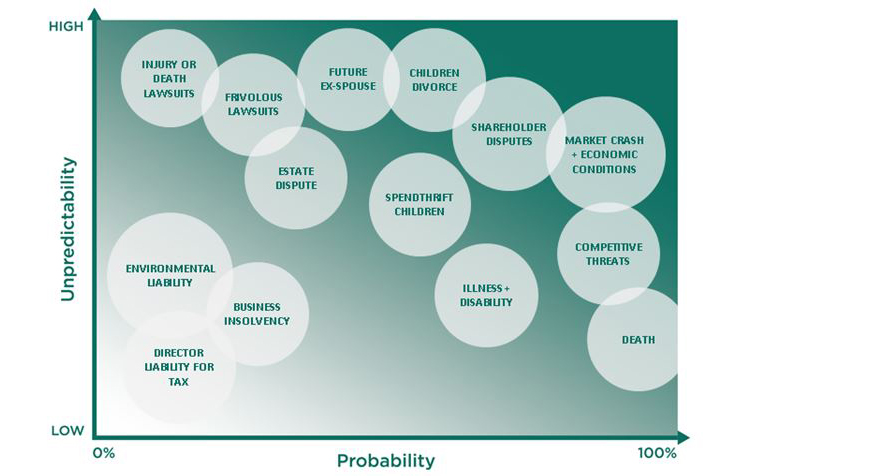

Asset protection planning is important for being successful and financially stable. This chart illustrates the unpredictability and probability of some events that may happen. The more unpredictable yet probable an event is, the more value you will gain through proper asset protection structuring.